child tax credit november 2021 late

Not too late to claim the Child Tax Credit for 2021. You can still access the child tax credit which for the 2021 tax year is worth up to 3600 per kid under 6 and 3000 per kid between 6 and 17.

Missing A Child Tax Credit Payment Here S How To Track It Cnet

947 ET Oct 21 2021.

. If Congress doesnt extend it the Child Tax Credit would revert to its pre-2021 level or 2000 for each child under the age of 17. Thats less generous than the enhanced CTC and also excludes. People can get these benefits even if they dont work and even if they receive no income.

But many parents want. New child tax credit payments are going out. This caused about 2 of child tax credit recipients to get their payments late that month.

IRSnews IRSnews November 9 2021. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. Most families will receive the full amount which is 3600 for each child under age six and 3000 for each child ages six to 17 in 2021.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. The advance is 50 of your child tax credit with the rest claimed on next years return. Families who sign up will normally receive half of their total Child Tax Credit on December 15.

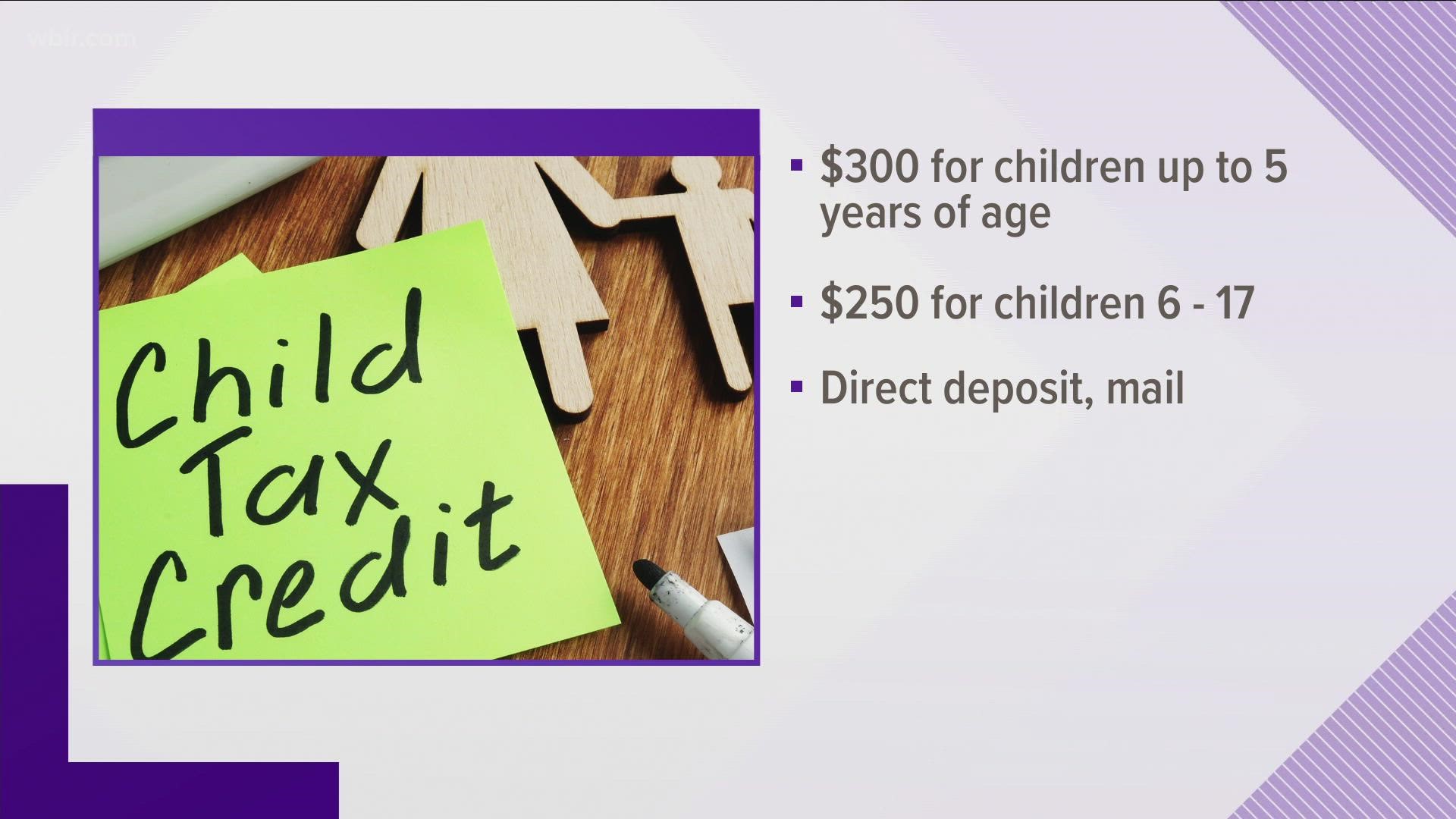

Ad The new advance Child Tax Credit is based on your previously filed tax return. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per. Low-income families who are not getting payments and have not filed a tax return can still get one but they.

Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. The updated Child Tax Credit is based on parents modified adjusted gross income AGI. 1201 ET Oct 20 2021.

Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it. The enhanced child tax credit which was created as part of the 19.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. The deadline to sign up is November 15 2021. Six child tax credit payments went out in 2021 and the rest of the money will come with your tax refund this year after you file your taxes.

The advance child tax credit payment is days away from going out. The 2021 advance monthly child tax credit payments started automatically in July. For those who claimed early the IRS has been sending families half of their 2021 child tax credit as monthly payments of 300 per child under six and 250 per child between the ages of six and 17.

847 AM EST November 15 2021 Another 15 billion in monthly advance child tax credit payments is set to go out Monday divided between tens of millions of Americans. November 12 2021 1226 PM CBS Pittsburgh. If you are eligible for the Child Tax Credit but dont sign up for advance monthly payments by the November 15 deadline you can still claim the full credit of up to 3600 per child by filing.

The Internal Revenue Service encourages taxpayers who missed Mondays April 18 tax-filing deadline to file as soon as possible. 645 PM EST November 12 2021. While taxpayers due a refund receive no penalty for filing late those.

Taxpayers who owe and missed tax deadline should file now to limit penalties and interest. 2 days agoAs of Fall 2021 138000 New Jersey families had yet to receive Child Tax Credits of up to 3600 per child amounting to more than 415 million in unclaimed credits. This means a payment of up to 1800 for each child under 6 and up to 1500 for each child ages 6 to 17.

IR-2021-222 November 12 2021. 445 PM MST November 12 2021 The November installment of the advance child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail next week. While the October payments of the Child Tax Program have been sent out many parents have said they did not.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. As November child tax credits are delivered parents have one last chance to sign up for advance payment Published Mon Nov 15 2021 116 PM EST Alicia Adamczyk AliciaAdamczyk. 2 days agoFamilies who dont owe taxes to the IRS can still file their 2021 tax return and claim the Child Tax Credit for the 2021 tax year at any point.

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Childctc The Child Tax Credit The White House

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Children 18 And Older Not Eligible 13newsnow Com

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Generate Rent Receipt By Filing In The Required Details Print The Receipt Get The Receipt Stamped Signed By Landlord Sub Free Tax Filing Filing Taxes Rent

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

What Families Need To Know About The Ctc In 2022 Clasp

Why Industrial Resin Flooring Is The Best Solution For Businesses In 2022 Small Business Blog Flooring Business

What Is Ctc Difference Between Ctc And Take Home Salary Tax2win Salary Income Tax New Job

The December Child Tax Credit Payment May Be The Last

Why Is There No Child Tax Credit Check This Month Wusa9 Com

Payments From The Expanded Child Tax Credit Are Being Sent Out Npr

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Gst Revenue Collection For December 2019 Revenue Knowledge News